|

| Image by Alexander Kliem from Pixabay |

{This post was commissioned by Profile Pensions and Mumsnet}

Did you know that the average person who takes pensions advice will increase their pension wealth by £31k? (1) That is a pretty massive amount, right? If you live frugally that is enough to keep you going at least another couple of years, or maybe you want to splash a good amount of it on a once-in-a-lifetime world cruise or the car of your dreams. Whatever it is that you choose to do with your money, there is no denying that £31K can make a big difference to the average person's life.

The Gender Pension Gap

|

| Image Credit |

Taking Control of my Pension

Last year I worked with Profile Pensions and Mumsnet to encourage women to complete a pensions health check and to look at their own provision for when they retire. This was such a good catalyst for me, as since then I've had my health check and made some changes. You know what they say about getting all your ducks in a row, so you're ready for what comes next? Well, after not saving for my retirement for the last six years I started to save on a monthly basis again, and even though it has been such a tough year with the Coronavirus pandemic I felt it was worthwhile putting a small amount aside each month and living slightly more frugally to allow for this.

This year Profile Pensions have a new pension investment advice service that has been designed to make you better off in retirement, by tracking down lost pension pots and improving their performance over time, through giving impartial investment advice. Profile Pensions say

"Saving for the future has become too complicated. Millions of people are not making the most of their pensions, or have lost track of them altogether. Many are unknowingly paying high fees for poor performance, and those who decide to self-manage can make expensive mistakes.

At Profile Pensions we use our expert knowledge and whole-of-market coverage to tell you how and where to invest today and in future. We keep our fees low and transparent. You can speak to a human expert whenever you like. Our service is available to everyone, regardless of how much you have to invest."

Help Finding Lost Pension Pots

Why Don't you Sign up for some Pension Investment Advice?

I'd happily recommend signing up to Profile Pensions for a free assessment and some advice of how you could improve your pension fund. It's simple and easy, all you have to do is -

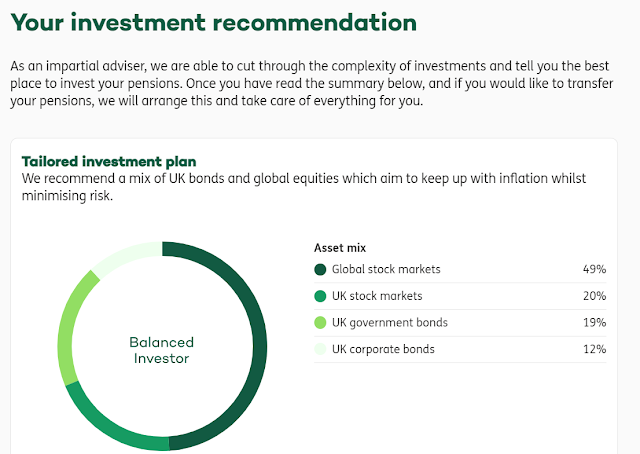

1) Sign up to get your free and impartial investment advice (click this link to get taken straight there). You'll get asked a few questions, like your age, marital and employment status, and your thoughts and plans towards your pension. Then you'll also answer a few questions to allow Profile Pensions to assess your attitude towards risk and thus be able to evaluate what might be the best kind of investment plan for you.

2) Find and/or transfer pensions - You can input the details of any pensions that you have, and if you're like me, having worked for a few employers you might have to input a few but it wasn't difficult and it took me no more than 10 minutes to get signed up. You can also request that Profile Pensions find pension funds that you might have lost track of.

3) Watch your money working harder for you - You can access your online account anytime or speak to an advisor. It is super easy to book a call appointment for a time suitable for you Monday - Saturday or you can email questions too.

I found it easy to sign up for my impartial investment recommendation and it was interesting to see what was recommended on the basis of my level of risk adversity. I came out as a balanced investor, which meant I was happy with a few short-term risks but couldn't afford to risk too much, even if it gave me the chance of far bigger returns. It turned out that two of my plans, including my biggest one that I paid in to for ten years, were unable to be transferred into a new investment due to incompatible features, such as one being a final salary pension scheme. This means that the three that can be transferred are not actually that much money but this doesn't matter as Profile Pensions services are accessible for all, even those with a small pension pot.

I'm still reviewing my investment recommendation and I'm going to book a call to talk it through with an advisor to get a better understanding, and the great thing is that the service remains free of charge to me, until I choose to transfer my pension funds into being managed by Profile Pension. At that point, there is a 1.95% arrangement fee but this will come out of my pension fund, rather than me having to find the amount upfront and the annual fee is also taken directly from the fund each year.

If you've lost track of your pensions and aren't really sure how your money is working for you, don't despair, you really aren't alone. There is no need to feel embarrassed, before becoming self-employed I was a HR Manager for 10 years and my pension fund is no-where near I need it to be, I surely should have known better!

Rather than beat yourself up, do something positive and sign up with Profile Pensions to get your impartial investment recommendation.

Sources

(1) Association of British Insurers, May 2020 | abi.org.uk

(2)

https://www.cii.co.uk/media/9224351/iwf_momentsthatmatter_full.pdf

(3) https://thepeoplespension.co.uk/info/wp-content/uploads/sites/3/2019/05/Gender-pension-gap-report-2019.pdf

(4) Based on over 6,500 policies located by Profile Pensions since January 2017